Saving is an important aspect in building wealth. While most people (if not everyone) can agree that being rich is better than being poor, discussing ways to increase one’s savings is usually not a common dinner table topic.

But behind every savings account can be a unique untold story. Let’s explore that today and learn how to supercharge your savings quickly with five methods.

This post may contain affiliate links, which means I may receive a commission, at no extra cost to you, if you make a purchase through a link. Please see my full disclosure for further information.

How to Account for Savings

Before we jump into how to increase savings, it would be helpful to understand the mechanism of savings.

In a nutshell, your saving is the result of what’s left after you spent a portion of your income. The more you earn and/or the less you spend will be the only way to increase your savings.

Let’s say for example your net household income (after tax) is $4,500 per month. A large portion of this will most likely go into living expenses such as:

- Rent (or mortgage): $1,500

- Utilities (e.g. electricity and water): $150

- Internet: $50

- Health insurance: $500

- Transportation expenses (car insurance, gas, or monthly train subscription): $300

This leaves you with exactly $2,000 after general living expenses are accounted for ($4,500 – $1,500 – $150 – $50 – $500 – $300 = $2,000). These are collectively known as fixed expenses.

Since these are hypothetical numbers, you can simulate a real-life situation by substituting the numbers from above.

Now let’s move on to accounting for the fun part – variable expenses.

To savings or to spending? That is the question

Unlike fixed expenses where the amounts generally do not fluctuate wildly from month to month, variable expenses are (for the most part) within our control.

In fact, the word “variable” implies that the spending amount can be changed or adjusted.

To illustrate, let’s continue with the same example from above.

With $2,000 left, you now have some power over how much you would like to save.

However, since our living expenses also involve eating, drinking, and actually living, we need to also account for these costs. Here are some general variable expenses (average per month):

- Grocery: $500

- Phone Bill: $50

- Cable or TV Subscription (e.g. Netflix, Disney+, or Apple TV+): $20

- Clothes, shoes & accessories: $80

- Beauty & other maintenance care: $50

- Restaurants/bars: $200

- Entertainment: $100

The amount you choose to spend here is directly tied to your standard of living. But for all intents and purposes, I think we can safely agree that grocery (or food) is the only necessity on this list while everything else is discretionary.

Controlling discretionary expenses can help increase savings

Discretionary expenses are variable costs that you can control. These are basically your “wants” rather than your “needs,” so understanding what they are can help you save.

In the example above, if you only account for eating (i.e. $500 in grocery expense), then what you actually save is $1,500 ($2,000 – $500).

But if you account for all of the expenses in the example above, then your savings would be lowered to $1,000 ($2,000 – total of all variable expenses). That’s because the other $500 is your discretionary spending, which is still very reasonable in this case.

BUT WHAT IF this month you decided to buy a spanky new iPhone 11 Pro Max with 256GB for $1,249 (or $1,374 with 10% sales tax)? That could easily throw you into the red zone and you’ll need to finance that extra $374 with a credit card.

AND WHAT IF you also wanted to go to an NBA game or Taylor Swift concert? Then your entertainment expenses will implode even quicker.

You see where I am going with this? Any slight movement in spending can trigger a change in your savings amount. And the worst you could do is fund your desire with debts.

How much you want to save is completely up to you, but if you want to put matters into your own hands, then here are five ways to increase your savings quickly.

(Don’t forget to SHARE, comment and subscribe.)

5 Ways to Increase Your Savings

1. Find your motivation to increase savings

If you ask me, I think it’s a total buzzkill to save for the sake of saving. What’s the point of hoarding money when we only have 4,160 weeks in our lives? (If we consider living till 80 years old that is.)

Let’s put that into perspective a little bit. We only have 4,160 weeks or 960 months in our lives, and half of those time we spent on working (from 25 – 65 years of age). We work to live, and then hopefully by the time we reached retirement we’ll have sufficient funds to enjoy the remainder years.

But sadly, the reality is that a lot of folks are not prepared for retirement. And that’s entirely driven by the fact that these people neglected their savings most of their lives. It’s very disheartening to know that people worked half of their lives and still don’t have enough to live through their retirement.

But WHAT IF there is another way?

What if you can save today to work less in the future and achieve financial independence after 10 – 15 years of working? By doing so, you would need to let go of some of the conventional “luxuries” and put priorities toward increasing savings, then investing.

This is pretty much the formula to reach FIRE (financial independence; retire early), which is a movement that is spreading in the millennials’ generation.

My financial goal is to reach FI (financial independence) within this decade (or by 2030, gasp!). So while I’m not spending frivolously, I don’t feel like I’m missing out because I’m saving towards a purpose, a financial goal! This makes the process of savings vs. spending a trade-off, not a sacrifice.

2. Budget to increase your savings

When we listed out the net income and expenses from our example above, we have essentially started the first step of creating a budget.

Having a budget could be a great way to save quickly because you can keep track of and control your earnings and expenditures.

To create a budget, you would first need to collect a historical trend of your income and expenses ideally in a 6-month or 1-year period. This would give you a better grasp of your average household income and spending.

Once you have your data, you can now budget by planning out what your future earnings and spendings will be. This plan will serve as a reference point to track and compare with your actual earnings and spendings throughout the year.

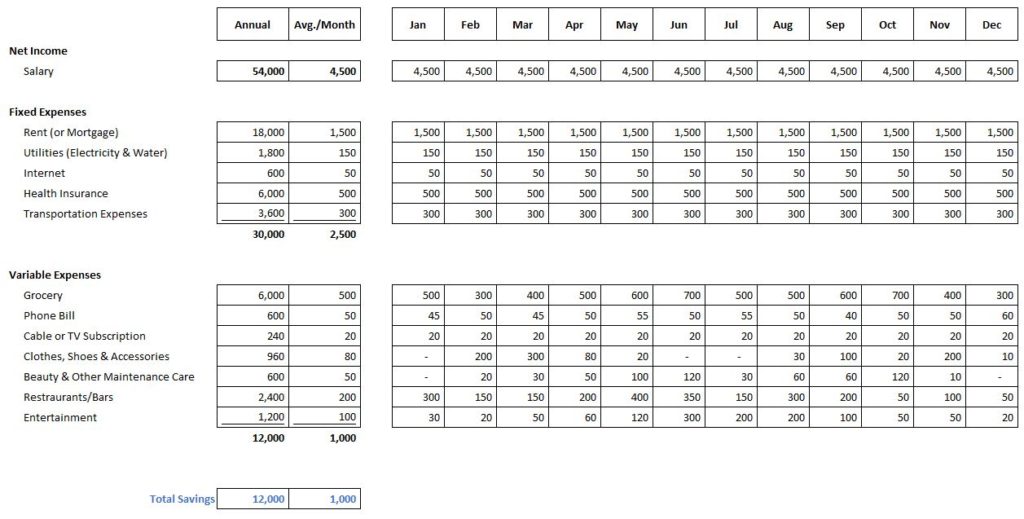

This example can be summarized in the following table:

You will see that your total savings is the difference between your net income and total expenses.

Using a budgeting template to increase savings

To budget in your savings, you would first target your ideal saving amount at the top, then work your way down.

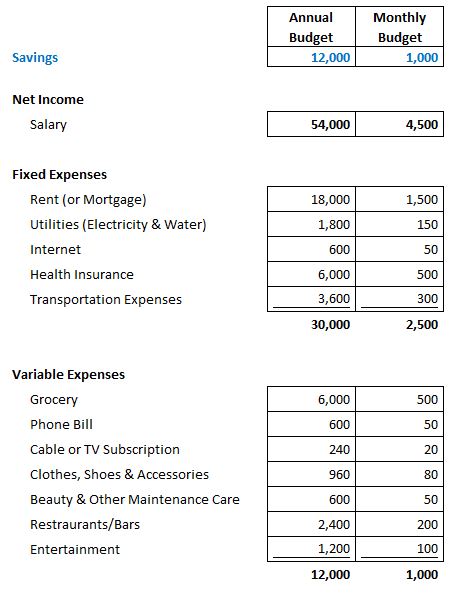

Budget example #1: Target annual saving = $12,000

Just be sure that your savings still reconcile with the difference between your net income and your expenses.

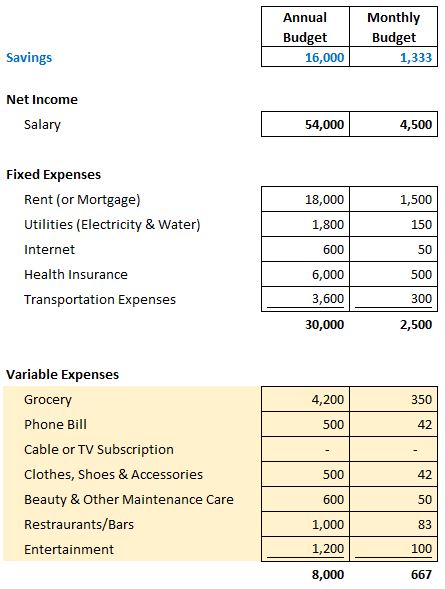

Budget example #2: Target annual saving = $16,000 (increase savings by $4,000 via reducing expenses)

However, let’s say that for this year, you want to increase your savings by $4,000 (or to save $16,000 annually), then you would want to cut back on some of the variable expenses as highlighted.

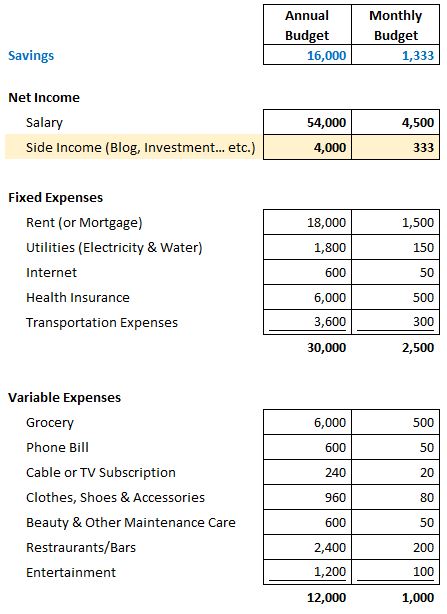

Budget example #3: Target annual saving = $16,000 (increase savings by $4,000 via increasing income)

On the other hand, if you want to keep the same living standards, then you would need to either increase your salary income or get a side gig such as starting a blog or investing to generate a new stream of income.

Therefore, by budgeting your targeted annual savings, you can work your way around your income and expenses to meet the goal.

Please note that while the details and categories of a budget may vary from household to household, the principal of budgeting to increase your savings will remain the same.

Related: Save Money Without Using a Budget

3. Reframe your lifestyle to reduce variable expenses

In our budget example above, we touched up on reducing variable cost of living. While it’s easy to make some manipulations on a spreadsheet, it could be a daunting task to execute in day-to-day life.

In fact, our discretionary spending actually tells a lot about our lifestyle choices.

Case in point: If you’re a frequent Starbucks drinker, at 5 cups per week (average $5 per cup), you effectively spent $25 per week or $1,300 per year. But if that’s okay with you, then no one should take away your daily dose of vanilla latte.

Another case in point: Going to concert really makes you feel alive. Yes, even though at $100 per ticket, going to concert is how you and your partner bond. You both feel so alive following your favorite band, so this entertainment is a must on your sanity list.

These are all lifestyle choices we elect to choose using our powerful dollar bills as votes. If you think of it like this, you may think twice about what you’re voting for.

Your dollar bill is your vote

If cutting back on several cups of vanilla latte has no effect on your overall happiness, then do it! When you elect to spend just 2 cups per week, you’ll spend $520 per year instead of $1,300. That’s a total annual saving of $780 with little pain to your stomach.

As for the concert goers, I’d say keep going to those concerts. If finding a joyful activity enables you to live more, then the hefty sum may be well worth it. Same goes with traveling, redecorating your house, or owning a pet. There’s no reason to cut back on joy as long as you know what they are.

So instead of living with suffering, the end goal here is to look for optimization opportunities where you eliminate discretionary spending that adds little value. When you cut back on the excess, you may find that you’re actually accumulating more joy in the form of savings.

By looking at a dollar bill as a vehicle of vote, you may elect to use your money wiser. This concept is derived from the economic principal of “dollar voting” by James M. Buchanan.

But without getting into the politics (or alluding to any of it), not voting in this case equals more savings. So save your votes because the dollar bill doesn’t have an expiration date.

4. Reframe your mindset to reduce fixed expenses

While reducing variable expenses may be within your control, reducing fixed expenses can be a different story.

Certainly, it is a lot harder to reduce fixed expenses because this requires a major adjustment to your lifestyle. What you need to do in this case is to reframe your mindset about your living standards.

For example, would moving from a 2-bed 2-bath to a studio be a drastic lifestyle change? What if you’ve discovered minimalism and you wanted to evolve your lifestyle into living with less?

When this mindset shift happens, you’ll automatically want to downsize without feeling the pain of deprivation.

Another scenario that comes to mind is transportation. If you feel the need to justify your success through buying a fancy car, then you’ll have to pay the price in the form of higher insurance cost and monthly payment (if you finance the car).

How important is it that your friends or your co-workers must see you with a fancy car? Does it really elicit respect from them or is it just uncharted stimuli that you formulated in your head?

Do true friends really care about what type of cars you drive? Does it really matter what your co-workers thought of you? These are just some of the deep-dive questions you can ask yourself when you decide to enforce a certain lifestyle standard.

Thinking differently can make a difference

By reframing your mindset about your lifestyle, you may find that a lot of things we pay for are arbitrary and add very little value in our lives.

For instance once we became parents, our immediate intuition was to upgrade our living standard.

But when we really thought about it, the apartment we have is just fine to accommodate another baby. Instead of yearning for more space, we made space!

As a result, we got rid of a lot of unused items by reselling them and made over $13,000. That’s a story for another day though.

But wait! We also downsized a bit by eliminating some of our lifestyle luxuries.

For example, Papa Bear sold his motorcycle after we had our baby. Since we would have less chance to ride the motorcycle together, he didn’t deem it worth keeping anymore.

Was it hard emotionally for him to sell his bike? Yes! But since it was just sitting in the garage for most of the days, we were paying unnecessary insurance coverage month after month. Not to mention the maintenance cost required to upkeep the motorcycle.

So instead of keeping his luxury, he reframed his mindset towards investing for the future. Thus with the $6,000 he got from reselling his Yamaha MT-07, he invested in the S&P 500 index fund.

Would this mindset work for everyone? Probably not. But it’s worth a try to find a trigger that works for you.

5. Be grateful for what you already have (not a cliché)

The final method to increase your savings quickly is simply with gratitude.

Take a moment and look around your house. You probably have everything and anything you needed plus more.

Most of us are lucky to have a wardrobe full of choices and a pantry with excess food. Feeling grateful and appreciative of the things you already have will stop you from buying more.

When you buy less, you naturally consume less and save more.

This is exactly the idea of Marie Kondo’s method to declutter. Notice she doesn’t emphasize on decluttering to have a clean home. Instead, she challenges us to give gratitude to the house that provided us shelter. And when we got rid of the clothes we no longer need, we say thanks for the service they provided.

I find this thought process to be quite useful beyond just decluttering. It could work in so many facets of our lives.

For example, have you given some thoughts to just how beautiful nature is? And the crazy thing is that it’s free to enjoy!

Stop and smell the roses

All it takes is just a glance at what’s around us – the trees, the leaves that are falling from the trees, and the flowers growing nearby, etc. Once you feel the appreciation for the things around you, you may immediately feel an abundance of wealth!

Okay, THAT IS a bit of a cliché, I admit. But in all honesty, once I became a mom I feel super grateful for the mundane attributes such as cleanliness, safety, and public decency. These things are what we sometimes take for granted, but are so important.

And so I find that if you can enjoy the simple things such as free community amenities (e.g. the park, forest, library or public museum), you might have less temptation to fill the void by paying for expensive ones.

And just because you’re not spending big doesn’t mean you can’t live it up to the fullest. If you want some inspirations, check out The Poor Swiss who despite having a higher income still chooses to live within his means.

An Advanced Method of Saving

By now, we have placed a heavy emphasis on saving, but that’s just the starting point.

If we were just to save and put all of our assets into a savings account, it would never catch up to inflation.

According to the FDIC, the national interest rate for savings account is only 0.09% while the consumer price index (CPI) increased by 2.5% in the past 12 months.

Note that the CPI is a measurement of the price increase for consumer goods and services and it’s often used to gauge periods of inflation.

This means that shielding all of our hard-earned dollars in a savings account will reduce the value of our savings over time. The only way to beat this is by investing.

While savings is the first step towards building wealth, investing has the potential to build everlasting wealth. But let’s not jump ahead of ourselves with investment before we build up a safety cushion.

In future articles, we’ll explore more on savings rate and high-yield saving accounts. We’ll also look into investment vehicles that we can use as savings toward financial independence and retirement.

Do you believe that changing one’s mindset can change the way you approach savings? Have you tried using a budget to help you save more? What are some of your best saving tips?

Save this PIN

Agree – it’s really helpful to find your motivation first up!

Great tips!

Thanks, Beth!

This is a fantastic post! The examples are so helpful. Pinning for future reference. 🙂

Make Life Marvelous

Thanks so much for pinning! 🙂

This is such a thorough post, that will likely help many. Getting my finances sorted was the best thing I did for myself.

Thank you!

We use money savings challenge every year, and it helps us with saving a bit, here and there. Thanks for sharing these great tips.

That’s great to hear! Any saving, no matter how small, is helpful for the long-run.

I’ve been working on paying myself first! It’s a hard concept when you’re also trying to paydown debt

I would first focus on getting rid of debts (besides mortgage) while building an emergency fund. Once you’re debt-free, it becomes easier to save.

This is something I needed to see because we really need to build back our savings. This was so informative! I am pinning and sharing with my hubby. Thanks!

Awesome! Glad this post is helpful to you. And good luck with saving!

Great basics for people who want to start saving some real money!

Yes, setting the foundation is so important. Once it’s secured, it’s easier to build up wealth.

LOVE charts and money saving hacks!! This is the year my husband and I will be debt free, almost there. We’ve used so many of these tools to make it happen!!

No more house payment here we come!!

Great post!

Lauren

http://www.AtHomeEntrepreneur.com

That’s wonderful to hear! It’s a great feeling to be debt-free. You can do it!

This is so great! Reducing discretionary and fixed expenses is the best way to get your savings up there!

Good luck on your FIRE journey!

Thank you so much!

Love the template you shared!

Glad you liked it. Maybe I’ll upload it to the Exclusive Resources Page.