Happy 2020! As we step into a new decade, have you planned your financial goals yet?

If not, let’s do that today!

Looking back, these past ten years have been a wild ride since the Great Recession.

Our economy has fully recovered and even rage forward to a new height, unemployment and interest rates are falling, and the tech sector continues to dominate the market including our household!

If you’re already an investor in a broad-based stock market index fund, you must have seen a substantial windfall in your portfolio. Congratulations; keep it up!

But for those of you who haven’t started yet (or have no idea what I’m talking about), fret no more, you came to the right place!

This post may contain affiliate links, which means I may receive a commission, at no extra cost to you, if you make a purchase through a link. Please see my full disclosure for further information.

Planning Your Financial Goals Requires You to Know Your Past

In this blog, I will unveil the curtain of investing in the stock market as well as other investment, saving and earning strategies so that you, too, can take advantage of the economic growth and be equipped to plan for your future.

Let’s not forget to plan for economic downfall as well because the financial market is like a roller coaster – So buckle up for the ride!

In fact, looking back at previous recessions, market downturns presented great opportunities to invest. Therefore my strategies will aim to capture both the upside and downside of the market.

But before we jump into investment opportunities (a more advanced subject in the grander scheme of financial management), you’ll need to first get your financial house in order.

In this post, I will help you map out your own financial journey from starting afresh to attaining financial freedom.

Then I will share with you some tips to crush your financial goals every step along the way.

But first, it is important to understand our past before we can plan our future. So, let’s take a quick trip down memory lane into the 2010s!

(Hint: This will be a great time for you to reflect on your financial journey of the PAST decade as well.)

A Journey to the Past and Reflection of the Last Decade

Exactly ten years ago, the recession has hit but it has not yet settled. Panic was still everywhere.

Jobs were cut, and layoffs and bankruptcies were amongst the news headlines. Let’s not forget the onslaught of housing foreclosures.

I had just graduated a year prior and settled into my entry-level job.

Bright-eyed, fresh-faced, and oblivious to corporate politics, I was full of hope and eager to make a difference and take on that corporate ladder.

Yes, that was the ambitious and hopeful version of ME 1.0.

In addition, I felt “lucky” (with a tad of anxiety) that amid all of the job bloodsheds, I was able to land a position in my chosen field – finance.

(Many of the graduates at the time of the Great Recession had a tough time finding a job in their field of study, and had to resort working in whatever industry that was hiring.)

At the time, the illusion of having a well-paid job that yields steady paychecks and a promise of growth were the tickets to a successful career, and I swallowed it whole.

The Employment Landscape Has Changed

Fast forward ten years later, the job market has undergone a major revamp.

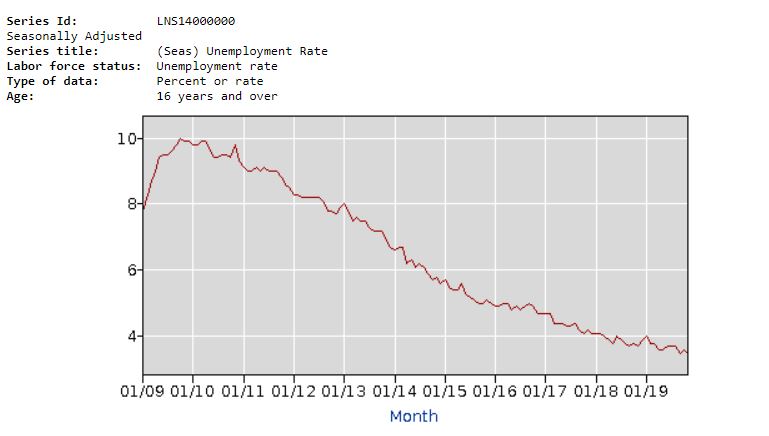

The national unemployment rate is now just under 4% from the high of 10% in 2010 (according to the U.S. Bureau of Labor Statistics).

But on the other hand, we now learned that a job is no longer everlasting, and a career can be annihilated as technology takes over (think Turbo Tax replacing the need for an Income Tax Accountant, Airbnb replacing the prospect of Hotel Management, and the list goes on).

We also stepped into another roaring 2020 where the stock market is at its all-time high just like in the previous Roaring Twenties that you read in history textbooks.

And Here We Are

No longer bright-eyed and fresh-faced, I now see the world and my career in a different light.

For the most part, it’s still full of ambitions and prosperous hopes, but with an injection of realism and a newfound sense of direction.

A ME 2.0 on a journey to become financial independent.

And now over to you!

Now that we have reflected on our last decade’s journey, it’s time to plan the next one ahead.

Continue reading below to learn how to map out your financial journey to achieve your goals.

(Don’t forget to SHARE, like, comment and subscribe.)

9 Steps to Plan Financial Goals & Map Out Your Financial Journey

In order to successfully plan for the future, you must first know where you stand.

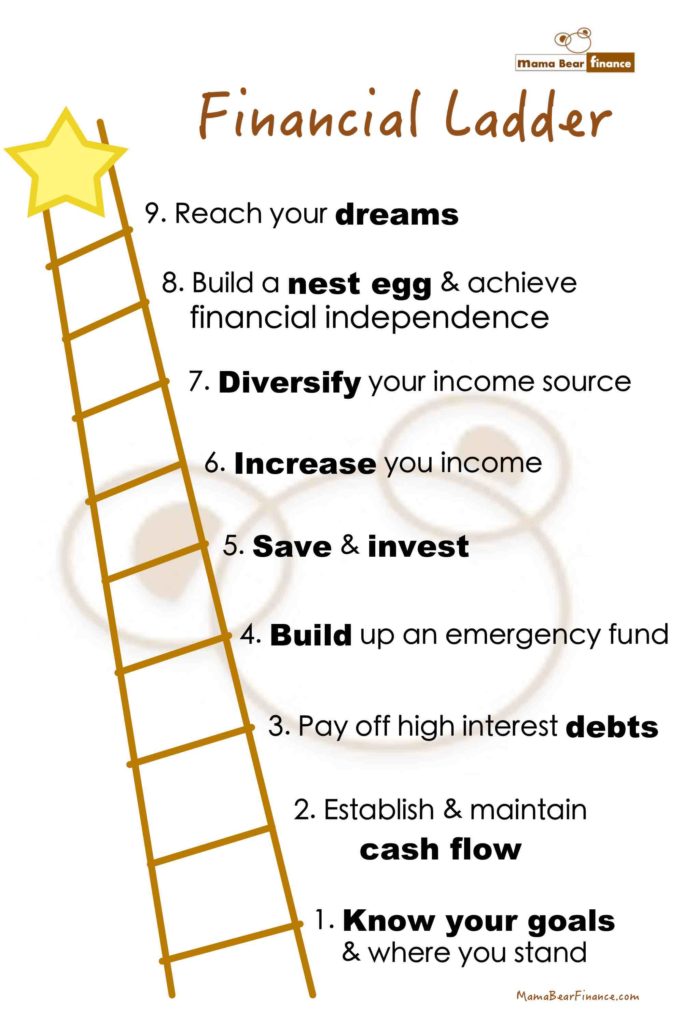

Here I have come up with a Financial Ladder to guide you through plotting out your financial journey and figuring out your starting point.

This Financial Ladder is comprised of nine steps and broken down into three parts: Start with the Basics, Build ‘em Up, and Get to the Top.

Depending on where you are in your financial journey, you can either skip ahead or come along every step of the way to reach to the top of the Financial Ladder.

Part I: Start with the Basics

Step 1: Know your goals and where you stand in terms of your financial health

Before you do anything with a tool, you must first read the instruction manual.

Except when it comes to money, there is no manual. So what do you do?

Well, instead of looking for the manual, you can look at it like a puzzle. The big picture once the puzzle is completed is your dream.

Your mission is to gather all those little puzzle pieces and put them together.

In financial terms, this means that you need to know what your goals are and where you stand in order to plan for the future. Here’s how you can do it:

- Write a list of ten financial goals and choose the top three

- Figure out your net worth (total assets vs. liabilities)

- Know your debt level in relation to your income (i.e. debt-to-income ratio)

- Gather your past expenses in a 6-month historical trend (or ideally a 1-year historical trend)

- Calculate your financial independence target

Additional Reading: Affluenza: The All-Consuming Epidemic by Thomas Naylor

Step 2: Establish and maintain a healthy cash flow

Here we go, are you ready to get into the action?

A cash flow is the movement of your money: how much is coming in and how much is going out.

Your mission here is to maintain a healthy net cash flow, one that has more inflows than outflows.

This requires you to focus on earnings more than your spendings (including those using debt).

Without a positive net cash flow, your hands are basically tied up. Heck, you might even go into bankruptcy!

So, the main goal here is to generate an incoming cash flow that is more than enough to offset the outgoing cash flow.

Step 3: Pay off debts (especially the ones with high interest)

Debts are like those heavy balls and chains tied to your feet; The longer you drag them, the longer they hurt.

However, not all debts are bad. In fact, some debts are a great way to build wealth.

Ironic, isn’t it?

Nevertheless, the goal of this step is to understand the different types of debt and how to manage each of them properly.

As a start, you can gather your data on all of the debts you have including:

- lender name and contact

- outstanding balance

- interest rate

- loan type

- payment terms (e.g.. duration of the loan, payment due date, and monthly payment due)

Then, crush the ones with the highest interest rate by paying them off and look for ways to reduce the interest rates of the remaining debts such as through debt consolidation.

If you have a mortgage, here’s how you can calculate the total interest you pay overtime: Mortgage Loan Amoritzation Schedule.

Related: How to Live Debt-Free

Part II: Build ‘em Up

Step 4: Build up an emergency fund

Just like the weather is not always sunny, your finances won’t always be full of butterflies.

My advice: Get yourself covered before the storm and brace for rainy days.

This requires you to put money aside to load up an emergency fund.

I know the terms ’emergency fund’ doesn’t sound sexy because it can be inferred to as unfortunate events.

So instead, how about we change this to ‘safety & fun fund’?

What this means is that this fund is reserved to keep you safe (who doesn’t like that feeling?) and in the absence of an unfortunate event, you can eventually use it to have fun!

Step 5: Save diligently and invest for the long haul

It’s no surprise that many Americans are not saving enough, especially when it comes to their retirement.

But you can change that, and you can do so today.

Just look for changes in your wallet and put them aside into a savings account or piggy bank.

No, don’t use that to get a coffee because you need a break from all these money talks.

Or go grab a bite because you feel lazy to make a sandwich at home. No, don’t start online shopping now for new clothes or shoes, you already got plenty.

Just don’t do it – but that’s only my advice. (Okay, do as you please, I’m not a cop.)

But once you’ve built up the strong bones of a savings warrior (some might call this a frugalist), then it’s time to slice up the investment pie and take a bite!

Beware: You should only invest in what you know, and only after you have mastered Steps 1-4 above.

An investment is not a gamble, but a way to attain profits.

In order to do so successfully, you must first build a strong foundation on personal finance so that you can navigate the alley of investment without risk getting punched in the face.

Want to learn more? Read about how you can increase your savings and invest now.

Additional Reading: The Intelligent Investor by Benjamin Graham

Step 6: Increase your income and/or develop new income streams

What are you earning right now? Cool, ramp that up!

There are numerous ways to increase your income. If you work a 9-5 job, you can negotiate (note: not ‘ask’) for a raise, network within for new opportunities, or look elsewhere.

Don’t settle, and don’t give up.

Therefore, this step requires you to know your worth.

So, here’s my question: What is your worth?

Another way to increase your income is to develop new income streams.

This is an interesting one as it requires you to discover your own creativity and leverage it. (Think Marie Kondo who turned her hobby of decluttering into a successful business.)

How to do that? Well, that’s exactly what this blog is for! – To explore entrepreneurship opportunities and side income ideas. Let’s find out together!

Part III: Get to the Top

Step 7: Diversify both your active & passive income source

The notion of job security or working till full retirement age no longer exists, so you might as well diversify your income.

A 9-5 job, for example, is an active income because it requires you to actively wake up, get dressed, and go to work in order to receive a monthly salary in exchange.

Another form of active income is to manage a side hustle or side income project (such as described in Step 6).

There are numerous possibilities to work on a side hustle thanks in part to the internet and the affordability to start one.

Some of the examples include hosting Airbnb guests, becoming an Uber driver, launching a Youtube channel, and my personal favorite, starting a blog!

Because all of these side hustles involve laborious time and effort, they are considered an active source of income just like a salary.

On the other hand, you can diversify your income further by developing a passive income.

Unlike an active income, a passive income requires no additional work except for the occasional monitoring and the “hassle” of spending that money because they just keep on rollin’ in (the problem of success I guess).

What are passive incomes? They can be part of the side income streams I mentioned in Steps 5 and 6 which are investments and side businesses.

For more info on active vs. passive income, read this post.

Step 8: Build a sizeable nest egg and achieve your FIT

Breath, we’re almost there!

Now that you have crushed and mastered all of the steps from 1 – 8 in your financial journey, here’s the fun part: Becoming financial free.

Remember you have already listed your top three financial goals and calculated your financial independence target (or FIT) in Step 1? Let’s review them and see where you stand.

If your answer here is ‘I’ve reached all of my goals and achieved my FIT,’ then WOW, what a job well done. Move on to the final step and pop that champagne!

Otherwise, I know you’re edging closer. With Steps 1 – 8 completed, you’re just few more inches away from becoming financially free.

Celebrate that. Enjoy this moment. And be proud that you’ve made it this far.

I’m still on this journey; and I’m here with you.

Step 9: Never stop caring for & investing in THYSELF and thy community

Ahh, you lucky duck! You’ve made it! Congratulations.

But wait, your journey isn’t over! It’s just the beginning of a diverted path that gives you a lot more choices and little financial worries.

The final step is more of a reminder.

I want to remind you that money is not the ‘be all and end all.’

It won’t solve all of your problems, and it certainly won’t make you any healthier, happier, or kinder.

However, it can provide you with the tools to become healthier, happier, and kinder, and sometimes solve your problems (if you can master using this tool wisely).

Therefore since you’ve made it here, remind yourself to never stop caring for your own well-being and those around you.

Continue to invest in yourself and in your community.

Most importantly, say thanks to those who tagged along the ride despite the many bumps on the road.

Financial independence is a lonely journey if you’re just doing it for yourself and by yourself.

As for me, I’m extremely grateful for my close family and friends. They stuck with me through thick and thin, and without them, I won’t be able to write such a post.

So, here’s to them! And to you, and a new decade full of happiness and success ahead! Cheers.

PIN this

What’s your vision for the next ten years and what are your financial goals? Which step of the Financial Ladder are you on currently? Any strategies you’d like to share to help others in reaching their financial goals?

I love how encouraging and honest you are! We’re right in steps 6 & 7 … it’s taking a lot of work to diversify but I’m keeping our vision of regular travel for our family of 7 in mind!

I love these tips and ideas. We have a budget every month and change it as needed. I keep track of everything for us. We’ve been moving a lot and some of our goals are to build up our savings, go on a family vacation, and buy a house.

I’m a saver by nature and very debt adverse so happily this is one area I think I have nailed (on to so many other areas thought that could use a boost!). Great article – I follow these tips and they work great

Loved this articular also enjoyed you rounding it up reminding that not all money is then end all and be all. I think we (I definitely do) forgot this sometimes.

Thank you! Glad you liked it.

We are working our way of that ladder slowly but surely. Great financial tips for making and reaching goals!

Awesome!! Thanks for your feedback.

Starting out with knowing how we spend our money – and how much of it.

Understanding your expenses is a good starting point to understand where you’re at in terms of your finances.

This article was really informative, I have been wondering often about whether it’s better to pay off debt as quickly as possible and delay putting money into savings, or whether to dial back on paying off debt in order to create a savings fund.

Glad you found this info useful and equally glad that you’re taking action to pay off your debt.

The answer to your question depends on the interest rate. Is the interest rate on your debt higher than the interest yield from a savings account? 99.9% of the time, it is, and if so then it’s better to first pay off debt and then save. Your savings account will accumulate faster without the debt burden as you no longer have to pay interest fees.

Hi Mama Bear, this is such a thorough and well-written out post. My financial goals this year include numbers 7 and 9 – to diversify my income and to invest in more financial knowledge, because I believe that there’s always something to learn despite all our achievements. It’s also good habit to look back to where we came from, realise how far we’ve come, and pay it forward. Again, I enjoyed your post 🙂

Thank you! I totally agree with you, learning is so powerful and we can definitely learn something from our past to help us envision our future. Glad you enjoyed the post and thanks again for sharing your financial goals!

Great tips! Diversifying my income should be one of my financial goals. I’d hoped to create an income stream with blogging but that is slow going. I’ve paid off all my consumer debt so now the focus is saving and investing.

Thanks for sharing your goals! Your blog is going to be a great source of side income and glad to hear that all of your consumer debts are paid off. You’re on your way up!

One of my goals for financial freedom is to finish paying my student loans. It has the highest interest rate right now. I also think I might get rid of my credit card once I’m done paying it but IDK…since credit score is such a huge deal in the U.S.

Thanks for sharing your goal. Do you carry any balance on your credit card(s)? Normally it’s best to first pay off credit card debts as they carry higher balance than student loans. And in terms of keeping up with the credit score, I know that credit companies do prefer consumers to keep at least a few credit cards open. It’s a pickle indeed. For me, I always pay off my credit cards in full as I don’t like to incur interest.

I like your chart – sounds pretty straight-forward.

I have to admit, though, I am not a numbers person, and “investments opportunities” give me anxiety. There are so many, how do you choose, and whom do you trust?

Luckily I have a personal friend who is a financial planner and also knows his pension and life insurance stuff.

Thank you! Yes, investment is not often a straightforward subject, despite how powerful it is in building wealth. Glad to hear that you have an insider friend who can help you navigate this.

I planned to write more about investment topics in future posts, so look out for them if you’re interested. 🙂