After almost a decade of homeownership, I often ponder whether or not buying a home was worth the investment. Today I’m going to do a case study on my home to answer this question.

To be clear, when we speak of homeownership, I’m referring to purchasing a single-family residence or condo rather than an apartment or multi-unit building that can be rented out.

Since buying a home is probably the largest purchase for most people, let’s investigate further to see if it’s worth the investment.

But first, is homeownership even an investment?

This post may contain affiliate links, which means I may receive a commission, at no extra cost to you, if you make a purchase through a link. Please see my full disclosure for further information.

Is Homeownership an Investment?

After giving in some thoughts, I believe that owning one house is not a good investment (and should not be considered as such). Owning two or more properties, though, is another story.

When you own one house, you will most likely not make a huge return if you have to re-purchase another one.

For example, when the market is hot and your house price is at an all-time high, you can’t cash in on the gain unless you already have some other place to live. Buying another home at this point means that you’ll repurchase at the high.

Conversely, when the market cools down, you won’t be incentivized to sell your home.

Perhaps you can sell at the height of the market and resort to moving into a rental, but that is hardly a good strategic move.

What if the housing market continues to edge upward while rent prices also increase?

You won’t know that; And nobody can predict just precisely how a market will perform. Therefore, the sensible thing to do when you own one home is to stay in that home.

But if homeownership is not an investment, then why do so many people buy it?

Buying a Home Is Not an Investment

One of the basic necessities in human life is to have shelter.

This is exactly why we buy a home at the expense of working long years to pay off a mortgage. In essence, owning a home means that we will have a roof over our head.

But buying a home is not an investment.

To illustrate, I’ll use my home as an example.

The True Cost of Homeownership

I often hear real estate agents tout how buying a home is the best investment “ever.”

Often times, they’ll cite the home price at the time of purchase (usually few years back) vs. its current market value.

The longer the holding period, the more attractive the home value will be. This is because home prices generally move upward unless we face a recession.

However, in between this holding period consists of many, many costs on top of the purchase price.

1. Mortgage Interest Expense

Since most people take out a mortgage to purchase a home, knowing how much interest is paid over the years is an important consideration.

When you have a mortgage, you incurred interest expense through your monthly payment.

This interest expense portion of your monthly payment is the cost of getting a mortgage. It is usually amortized over the life of the loan.

For my mortgage, I paid a total of about $50,000 in interest since I had paid it off early (in 8 years instead of 30). This was not a light decision, but I did so to become debt-free.

Luckily, there was no prepayment penalty.

2. Property Tax

Property tax is calculated based on the purchased price and assessed each year based on the value of a property.

The amount of property tax levied also varies based on locale. The more favorable the property is located, the higher the property tax.

In addition, every city, county, and school district each have the authority to levy taxes against the properties within their boundaries. This is an important factor to consider for parents since we all want to place our childing in a good school district.

Over the years, the housing prices have steadily increased since rebounding from the Great Recession. The annual property tax that I’ve been paying stood at around $5,300 per year. This equates to about $440 per month! (And my house is located in an average neighborhood in a high cost of living city.)

3. Home Insurance

Having home insurance is mandatory when you have a mortgage. Lenders do not want to take risk in case something happens to your house!

But even after I had paid off my home, I still continue to opt for home insurance. Part of it was because I’m used to accounting for this expense, and another part was for the peace of mind.

So I pay on average $600 per year or $50 per month.

4. Utility Cost (Water)

Renters generally pay for their own electricity and gas bills. This is the same as for homeowners.

The only extra bill that homeowners are in charge of is water bill. As renters, water is included in the rent.

The annual water bill I pay is around $600 per year or $50 per month.

5. Maintenance Cost

Sigh… this is the part that can cause the most headache as a homeowner.

When you rent a place, you can easily call up your landlord to fix whatever there needs to be fixing.

But as a homeowner, you carry the burden of paying for the cost of maintaining your place.

Unfortunately, I don’t have the exact figure of how much maintenance cost we incurred, but over the years, I’d say I paid around $12,000. Let’s just assume that it cost around $1,200 on average per year or $100/month.

The major maintenance cost we spent on were re-painting, re-piping, fixing bathroom clogs, gardening or landscaping, and general maintenance.

6. Remodeling Cost

Sometimes, maintenance is just not enough and you have to remodel a part of the house. Other times, you may want to expand and add a room or a toilet.

Since the house I bought is now occupied by my parents and they love cooking, I decided to remodel the kitchen before I moved to Switzerland.

The cost of remodeling the kitchen entirely cost a sweet $10k back in 2013. This includes replacing the cabinets, stove and refrigerator, plus labor.

Since then we have not remodeled the home.

Hey, What About Tax Deduction!?

As I mentioned interest expense earlier, I should have also included the nuance of tax deduction from having a secured mortgage.

Even though mortgage interest is an expense, it also comes with the reward of tax deductibility.

Unfortunately, I was not able to take advantage of this perk after I left the U.S. soil.

Even though I have to file U.S. taxes annually, I’m not qualified to deduct my mortgage interest since my earnings came from abroad.

In all honestly, I had no idea until I filed my first year of tax as an expat.

So all in all, I received three years of tax refund during the period I was working in the States as a homeowner. That amounted to $15,000 or $5,000 per year.

This was certainly a gain that I should consider, but a temporary one for my case.

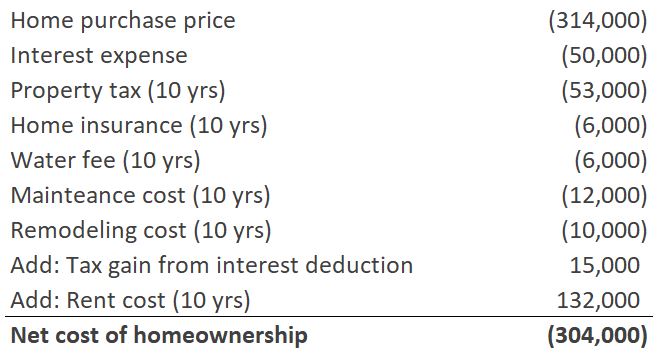

Adding It All Up

To get the full picture of homeownership, I would need to add in the purchase price plus the comparable rent cost.

The purchase price I paid for my home was $314,000.

For comparable rent, I will use the amount before the home purchase which was $13,200 per year. Since this is an offset cost, I will add it back to the net cost.

For the sake of simplicity, I will calculate the total cost of homeownership for 10 years.

This is really interesting.

What the net cost of homeownership tells me is that if I were to sell my house after 10 years, I would break-even if I were to sell it at $304,000 in net profit.

This means that if I were to consider my home as an investment, my return would be the excess of the sales price minus the net cost ($304,000).

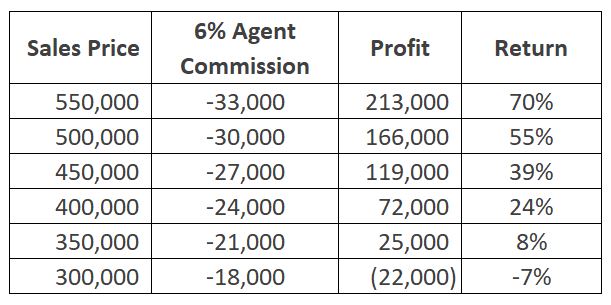

Let’s run a what-if analysis at different sales price point:

Since I’ve never sold a house before, I don’t have a clue to what the real cost of home sales would be. What I do know is that the seller is responsible for the 6% real estate commission fee which has been included in the table.

If we consider taxes and other transactional costs, the return would be unequivocally lower.

But for simplicity’s sake, I will deduce that the sweet spot for selling my house to be above the $400,000 price point.

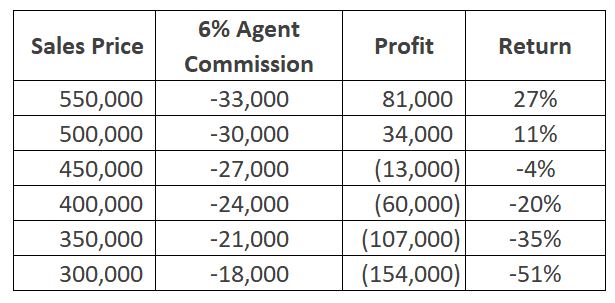

What If I Want Free Rent for 10 Years?

To get free rent, I can simply disregard the total 10-year rent cost of $132,000 from my calculation. In this case, the break-even sales price point would be $436,000 instead of $304,000.

The what-if analysis on the return would then look like this:

In this scenario, selling my house at $450,000 gives me a negative return! And this is considering the fact that I bought at THE LOW (i.e. during a recession).

Therefore, the sweet spot for selling this particular home would be around the $550,000 price point. The end result? About $81,000 in profit + 10 years of free rent. Not bad.

So Is Buying a Home Worth It?

Firstly, please keep in mind that the simulation I presented is based on my unique situation.

If any of these variables change, the whole analysis could be significantly different. (E.g. Paying a longer mortgage term or doing a bigger remodeling work.)

But while the homeownership variables may change, the conclusion that homeownership is not an investment remains sound.

The thing is, if I were to sell my house at any given price point, I would still need to repurchase another one. And if I sold during the high of the real estate market, I would rebuy at the high also. Meanwhile, it just doesn’t make sense to sell at the low.

Therefore, regardless of what my home is valued at, this first primary home is not really an investment.

If you’ve read my guest post on why I bought my house at age 25, you’ll learn that I was very nervous to have bought one during the Great Recession.

Essentially, I took lots of risk for buying at a time when people are offloading their real estates.

If and when a recession hits the housing market, my home value can easily slip below the rate of return that was once favorable.

And if the home price goes back down to when I purchased the house during the last recession, then that would essentially wipe out all of the gain plus I would have had incurred the extra cost associated with homeownership.

It’s Worth It

Buying a home is a huge commitment, yes, but it’s still worth it.

That’s if you view it simply as a place for shelter instead of as an investment.

Historically, the average return on residential real estate has only kept pace with inflation. There are much better investments out there that can generate greater return!

Moreover, there is no return unless it’s sold and a house is an illiquid asset. Nevertheless, owning a piece of real estate within a portfolio of other lucrative investments provides diversification – and this in itself makes it worthwhile.

So bottom line, was this home a good purchase? Absolutely. Was it an investment per se? Not quite.

Related: How to Live Debt-Free

Do you think buying a home is considered an investment? Why or why not? If you’ve sold a house before, what was your return on the sale?

Here’s a PIN

We were on the fence about buying a home about 10 years ago. We eventually bought a 550K home with 20% down. About a year and a half ago, our home was appraised at almost 800K. We did a cash out refi. We used the cash to build a vacation/rental home in a sought after mountain community. It was the best financial move we ever made.

After expenses – we average about $3000/month in passive income on our rental property. 2/3 of our “winnings” go into an investment account. The other 1/3 goes toward the principal on our primary home. That doesn’t include the tax benefit we’ve received from writing off expenses and depreciation.

In the next 7-10 years – we are looking to sell the 2nd home, pay off the first home – and be completely debt-free and financially free.

None of this happens without our initial home purchase. Home equity matters. Using that equity to re-invest in another appreciating asset with passive income was huge.

This makes sense, especially in today’s low interest environment. Really glad to hear that buying your initial home worked out well for you guys!

I am writing a blog post about homeownership and your story is very inspiring to many. Is it okay if I quote your comment in my blog post, Ashe?

Wow, this is an extensive guide! Thank you for this!

Thanks! And no problem!

We have been renting for so long, it’s actually driving us crazy! We just want that feeling of “mine” you know? Thank you for breaking it down!

Yup, I totally get it. In next post I’ll discuss the real estate cycle. We may be heading towards a recession so this is a good time to start thinking about buying if you’re ready.

My husband and I bought a home early, and now we are wanting to move out because of the neighborhood changing. You were very technical which was helpful

Oh I see. In this case, it’s worth selling if the neighborhood is no longer desirable.

The TRUE cost of homeownership is so hard to calculate. It’s easy to think you’re just throwing away money by renting, but that’s not always the case! This breakdown makes so much sense!

Yup, sometimes renting can be better than owning. It’s a case-by-case situation.

Great post! I always think of a home purchase as an investment, so this puts a lot into perspective. Thanks for sharing.

You’re welcome!

Great article! I always wanted to buy a house because I feel like I’m throwing money away paying rent.

I know the feeling!