A mortgage loan amortization schedule is probably the most important tool that a homeowner and a homebuyer should master.

Knowing how to use one could help you better plan your future finances, explore savings opportunities, and achieve faster mortgage payoff.

In addition, having one available can put into perspectives of the true cost of homeownership. This can be an eye-opening exercise for those looking to become a homeowner or worry about their debt burden.

In fact, building out a mortgage amortization loan schedule was THE motivation to help me pay off my mortgage within eight years’ time.

Today, I will share with you what a mortgage amortization loan schedule is, how it works, and ways to reduce your interest expense.

This post may contain affiliate links, which means I may receive a commission, at no extra cost to you, if you make a purchase through a link. Please see my full disclosure for further information.

Think Like a Banker

When I bought my first house, I was immensely overwhelmed by the amount of paperworks I had to sign.

However, one thing I paid close attention to was the interest I owe on the loan. That’s because I was working at a bank at the time so I naturally thought like a banker rather than a homeowner.

You see, when you’re at the position of a bank, any loan you grant is essentially an investment. And with any investment, the investor demands a form of return. In this case, the mortgage interest.

When I took out my mortgage loan, I saw it as having an investor who granted me money to invest in a property rather than my buying a house.

Indeed, when you buy a house with a mortgage loan, you’re not fully buying it outright. You’re essentially one of the owners alongside your lender.

So my main mission was to keep track of how much I really owe vs. the amount that was building equity.

This is where a mortgage loan amortization schedule kicks in.

What Is a Mortgage Loan Amorization Schedule?

A mortgage loan amortization schedule is a series of mortgage payments that breaks down the allocation of each payment.

The two main components of an amortization are interest and principal.

While the principal portion is applied towards your equity, the interest portion is basically the COST of homeownership.

This cost is what the bank makes (i.e. return) by lending you the money to purchase a home.

So essentially, the bank uses amortization to calculate the loan balance overtime. A loan amortization schedule is, then, a tracker of loan payments that details the loan balance month by month.

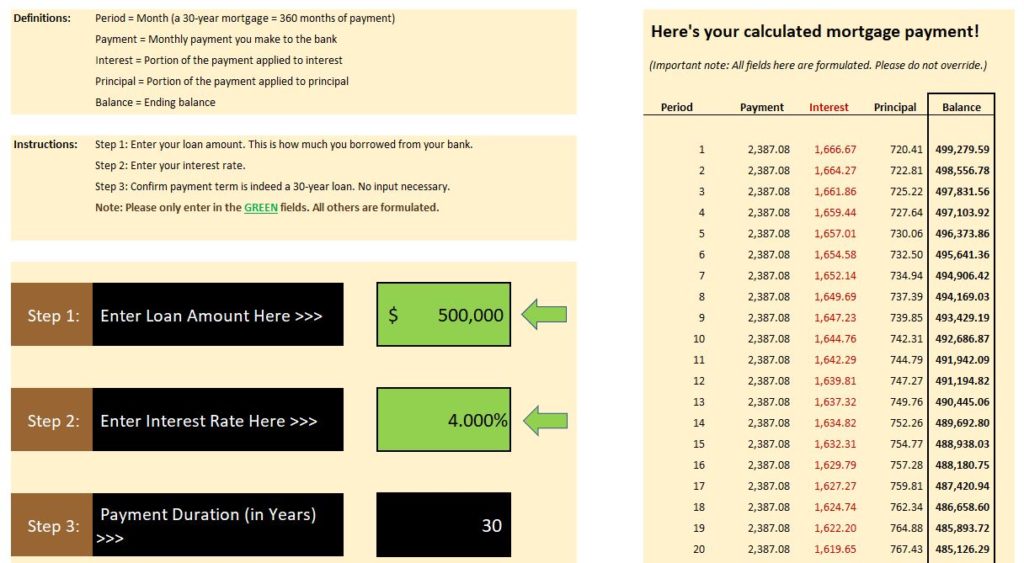

Here’s how the schedule looks like on the right:

To help you better understand how a mortgage loan amortization schedule works, I created the above tool in Excel that will calculate your mortgage payment in 2 simple steps.

If you’re already a subscriber, you can download this on the Exclusive Resources Page now. I will use this tool to demonstrate how a mortgage amortization loan schedule works throughout the rest of this post.

If you’re not yet a subscriber, you can sign-up here to get the template (for free of course):

How Does a Mortgage Loan Amortization Schedule Work

A mortgage amortization loan schedule should calculate your periodic payment to show you how much you’re paying towards the interest vs. principal.

For example, if you bought a house for $625,000 with 20% down payment, then your mortgage will be $500,000.

Let’s imagine you signed a 30-year loan with 4% interest, then your monthly balance will be $2,387.08 per month.

This is all calculated based on the amortized loan payment formula.

If you have the Excel already opened, you can simply plug in your mortgage amount and the interest rate, and the rest will be automatically populated for you.

And if you’re in the process of buying a home, it’s also worth doing this exercise so that you can plan your future expenses.

Now let’s take a closer look at the mortgage interest and principal.

Mortgage Interest vs. Principal

You want to pay attention to the interest you pay your lender because this is entirely an expense.

An expense is the cost that you pay for a good or service. In a mortgage, the expense is essentially the interest you pay in your monthly payment.

Meanwhile, the principal is the remaining portion that helps you build equity.

The formula basically looks like this:

Monthly Payment = Interest + Principal

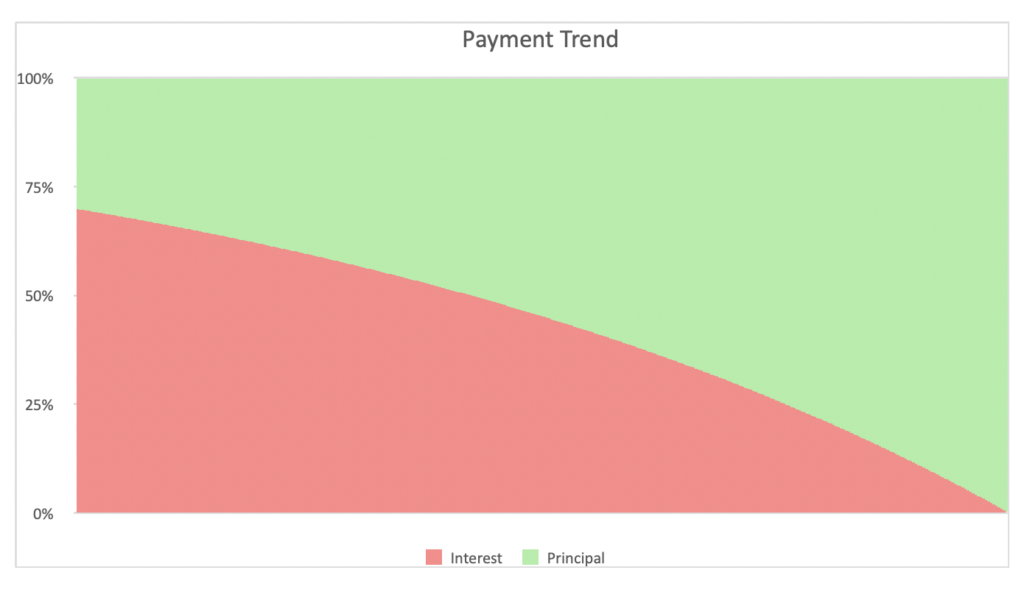

In the beginning of the loan, A LARGE portion of your monthly payment goes towards interest.

The following graph shows the amount of interest (in red) vs. principal (in green) over the life of a typical mortgage loan.

The way this is calculated directly benefits the bank because your ability to payoff the loan is much more difficult at the beginning. (After all, this is the reason why you would need a mortgage.) And so you would pay more in interest at the onset.

As time goes, your monthly payment will slowly shift in favor towards the principal until the entire loan is paid off.

Going back to the $500,000 mortgage loan example, you might learn that the interest expense is quite significant.

In the case of a 30-year loan with a 4% interest rate loan, the total interest amounts to $359,347!

This means that at the end of the loan, the TOTAL payment (interest + principal) will equal $859,347. ($500,000 = principal; $359,347 = interest)

That’s a whopping 42% of the entire payments to be made over the life of a loan.

How to Reduce Interest Expense

Reducing your interest expense means that you can put money into better use. After all, these expenses do not add any equity to your house value.

Here are some ways you can reduce interest expense:

- Make extra payment towards the principal

- Refinance your loan to lower the interest rate

- Refinance your loan to shorten the payment term (e.g. from 30-year to 15-year)

Notice that the first option is completely within your control. It helps if you can increase your savings to use it towards paying down debt.

On the other hand, refinancing may not always be under your control. This is the case when the lenders decide to tighten their lending standard or when the interest rate goes up.

Evaluating the Pros and Cons

Additionally, it’s important to consider the pros and cons of paying down your mortgage such as taxation and opportunity cost.

For example, mortgage interest is tax-deductible which is a huge advantage. Meanwhile, you may consider investing any extra money you have or using it for other purpose.

In my opinion, however, paying down a mortgage is ALWAYS sensible since I’m effectively lowering my monthly expenses. Plus, it gives me the peace of mind when the mortgage is fully paid off.

Not only that, my personal circumstance as an expat means that I don’t qualify for mortgage interest deduction even though I have to file U.S. taxes annually.

And because of all of these factors, I was extremely motivated to pay off my house much earlier than planned.

But once again, it’s important to evaluate all of the pros and cons before making a decision since our situations are unique.

The first step, however, is to know exactly how much you pay in interest and principal over the life of a loan.

And for those who aren’t homeowners yet but planned to become one, knowing how your payments will look like can help you better plan your finances. Sometimes, buying a house may not be the right solution.

We’ll explore more about this in upcoming posts.

If you’re a homebuyer, are you aware of mortgage amortized loan and how it works? If you’re a homeowner, are you using a similar tool to track your monthly mortgage payments?

PIN sweet PIN