If you’re looking for a seamless way to manage your finances, here is an ultimate guide to help you. It consists of organizing your finances around three key elements:

- Net worth

- Spending habits

- Cash on hand

What’s interesting about these three elements is that they resemble how a business organizes its financials.

These 3 components are collectively known as the financial statements. The only difference between a personal financial statement and a corporate financial statement lies in the complexity and relevancy.

For the most part though, a personal financial statement should be much more straightforward and less daunting. Once you learn to manage your personal finances like a business, you’ll naturally become more efficient at handling your money.

After all, you should always manage your finances like nobody’s business except your own.

This post may contain affiliate links, which means I may receive a commission, at no extra cost to you, if you make a purchase through a link. Please see my full disclosure for further information.

How to Manage Your Finances

Before you start managing your finances, you should aim at organizing your financial information. This includes gathering:

- A list of the appreciating assets that you own (the keyword being “appreciating”)

- A list of the liabilities or debts that you owe

- How much you earn

- Your monthly expenses

- Your cash holdings

Before we get into the details, it’s important to note that this ultimate guide is how I would organize my finances. It serves more as a guideline than a cookie cutter framework.

After all, how you approach the classification of assets, debts and expenses could be slightly different, but the principles should remain intact.

Now, let’s get into the details on how to organize the data you collected.

Manage Your Finances by Knowing Your Net Worth

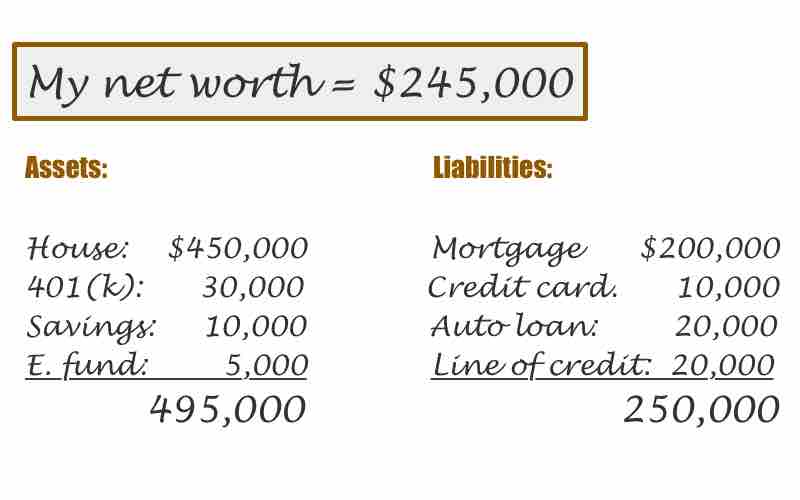

Your personal net worth is how much you own vs. owed. The bottom line can be a positive or negative figure.

When your net worth figure is positive, this represents how much you own.

On the other hand, if you find yourself with a negative net worth, it means that you may have spent way too much.

Here’s step-by-step on gathering your net worth data:

Step 1: Determine what you own

As a guideline, we would only count appreciating assets into the net worth calculation.

Appreciating assets are things that gain value. This makes calculating the net worth much easier and provides a more conservative figure.

When organizing finances, you want to go for easy and conservative because it’ll give you a figure closer to reality.

Here’s a list of examples of appreciating assets:

- Real estate (e.g. your primary home, rentals, land, etc.)*

- Retirement account balance

- Savings and/or CD (certificate of deposit) account balance

- Brokerage or investment account balance

- Emergency fund**

- And anything else that is expected to go up in value

*Determine if you want to use book value or market value for your real estate. Book value is the figure at the time of purchase while market value is what the real estate is currently worth. To stay conservative, I always like to use the book value.

**Even though an emergency fund is not technically an appreciating asset, I’d still count it since you could theoretically get more out of this by not borrowing money during bad times. Another exception could be cash if you hold a significant amount.

The reason why you’d only want to include appreciating assets is to avoid overcomplicating the assets that you own.

Here’s a list of depreciating assets that shouldn’t be included:

- Physical cash or checking account*

- Car(s)

- Furnitures

- Jewelries and clothes

- Gadgets like your phone, computer, etc.

- Kids’ stuff or toys

- You get the idea

*Physical cash or money in your checking account should be used for day-to-day expenses and thus they shouldn’t be included in the asset calculation. This is unless, of course, you hold a significant amount.

Again, this is just a guideline. And you can define your exceptions.

Step 2: Determine how much you owe

Anything you owe is known as liabilities which are expected to be repaid. This most commonly includes:

- Credit card debt

- Student loan

- Auto loan

- Personal loan

- Mortgage/Line of credit

- Etc.

Step 3: Subtract what you owed from what you own

First add up everything that you own and owed. Then subtract what you owed from everything that you own.

And that gives you your total net worth. Having this system of asset and debt organization in place will give you a better understanding of what you own vs. what you owed.

Related: How to Live Debt-Free

Manage Your Finances by Understanding Your Spending Habits

To understand your spending habits, you’ll need to figure out how much you make vs. how much you spend.

Understanding your spending habits is a key element to managing your finances because it reflects your savings rate. At the end of the day, how much you save is the key to acquiring more assets to add to your net worth.

For example, when you live below your means by spending less than what you earn, you’ll end up having more in savings.

On the contrary, when you live above your means, you’ll have less savings and possibly a negative net worth.

Here is a step-by-step instruction on how to figure out your spending habits:

Step 1: Know how much you make

This part is quite self-explanatory especially if your only source of income is your pay check. In this case, write down your expected salary (net earnings after tax) in a 12-month period.

If you make more than one income, list them out, then add up the total by month. Having a 12-month period would give you a better picture of your overall spending pattern.

Step 2: Track your spending

Tracking your spending can provide a valuable picture about your spending habits.

If you use a credit card, simply check the statement and categorized the spending. These categories may include:

- Rent or mortgage

- Grocery spending

- Eating out

- Gas for car

- Electricity, water, and/gas bill

- Phone and internet bill

- Spending on baby

- Etc.

It’s more ideal to organize this information in a 12-month period (just like your earnings), so that you can see your spending habits.

Why did you spend more on one particular month more so than another? Do you consistently go online shopping for non-essential stuff? Do you spend more on eating out than on groceries?

This trend should tell you how you spend your money.

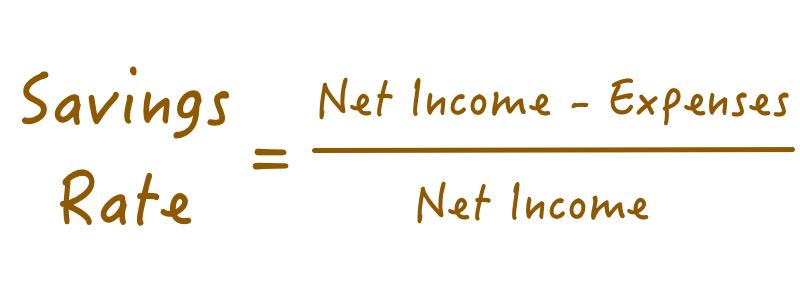

Step 3: Calculate your savings rate

Once you have the earnings and spendings in a 12-month period, subtract the spending figure from earning month-by-month.

Whatever left over is your savings. To obtain the savings rate, divide the savings from total earnings. This reflects the amount of money, expressed in ratio, to gauge your level of savings.

Here is the formula:

Note: You can multiply the end total by 100 to get the percentage. Here’s an article that explains more about savings rate.

Manage Your Finances by Calculating Your Cash On Hand

Cash flow is basically the incoming and outgoing flow of your cash. To organize your cash balance, you can calculate your cash on hand by tracking its movement.

If you find yourself having a negative savings rate, this means that you spent more than you earned. How is this possible? Perhaps you put more purchases on your credit card(s) than you intended to.

But in most cases, your ending cash flow balance should be a positive figure.

Understanding how much cash you have on hand is a good way to track how you allocate your capital. If you have too much cash, you’re not putting them to work such as through investing. But if you don’t have enough cash, you may not be able to pay the bills.

Therefore, striking a balance is the most important mission.

Here’s how you would track this information:

Step 1: Find our your current cash balance

Let’s say you started to organize your information in August. Your current balance should be the ending balance on August 31.

You can find out this information through your checking account. If you have extra physical cash that’s adds up to a significant sum, include this in your total.

Step 2: Repeat and calculate

In September, you’ll again account for the ending balance as of September 30. Once you have the two months, subtract the current month from the prior month to find out whether your brought in or spent more cash.

If your balance in September is lower than in August, then you must have spent more cash. And vice versa.

Once you have these two information, you can calculate whether you have cash inflow or outflow from the two months.

Repeat this process in a 12-month period to understanding your cash movement throughout the year.

Important note on cash flow

This cash flow methodology is really designed to track the amount of cash you have.

In today’s society, we don’t usually keep much cash on hand as we rely more and more on credit cards and digital payments.

This is why I don’t include cash into the asset part of the net worth calculation.

However, if you have significant cash on hand, you can certainly consider putting that into assets. But just note that the more cash you have, the more exposure to inflationary risk you have as well.

Another note regarding this methodology is that the cash flow calculation for a business is entirely different from personal finance. This is because businesses are much more complex and they are subjected to more rules and regulations.

But for the sake of efficacy, we’ll keep our calculation simple and straight-forward.

And That’s How I Manage My Finances!

This ultimate guide provides the steps I follow to get my financial house in order.

Even though this guide has served me well, you may want to tweak and adjust it to your liking.

I recognize that everyone’s financial situation is unique and a cookie cutter approach just wouldn’t work.

Nevertheless, if you struggle to know your net worth, spending habits and cash on hand, this ultimate guide will give you a good direction to start managing your finances in an organized manner.

Related: Why I Track All of My Baby Expenses

PIN this guide