After tracking EACH and EVERY expense for the past 12 months, I can now confidently start budgeting the cost of raising a child for the second year.

Budgeting is a great way to plan for future spending, set financial goals, and rack up savings.

Even though every household’s budget and expenditures are different, one thing we can all do is to keep our spending under control.

After all, there’s still a whole lot of years ahead of us in raising a kid! If you want to learn how to keep costs under control and save more while providing optimal care for your child, then read on!

This post may contain affiliate links, which means I may receive a commission, at no extra cost to you, if you make a purchase through a link. Please see my full disclosure for further information.

Budgeting 101

Budgeting is essentially a process of creating a financial plan to allocate funds.

In order to create a budget that is as close to the reality as possible, you need to know your actual expenditures.

This can be accomplished by gathering your historical spendings and divide them into separate categories and time period.

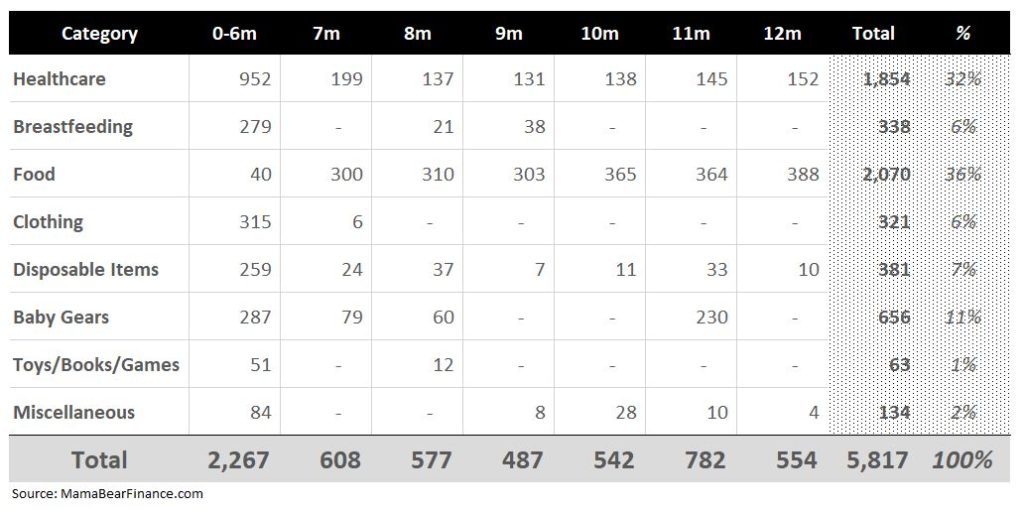

For example, you can go back to your credit card or bank statement history and organize your historical expenses in a table like this…

Our actual spending in the past 12 months:

If you don’t have the actual spending, then you’ll have to guesstimate your monthly expenses.

Now, let’s start budgeting!

Budgeting Step 1: List out the categories for your budget

Since my toddler is no longer a baby (aww…), there will be some categories that I’ll have to adjust to reflect my projection of the reality.

For example, the 13th month marks my final month of breastfeeding. Neither Baby Bear nor I desire to continue, so this category will no longer be relevant moving forward.

Secondly, we want to budget in traveling as a category. During the first year, babies can be a “lap baby” on an airplane. But once they become older, they’ll need their own seat.

Finally, we plan to put Baby Bear into part-time childcare so I’ll need to budget for that.

The following will be our new categories:

Healthcare, food, clothing, disposable items, baby gears, toys/books/games, travel, childcare, and miscellaneous

*You can add, remove, or replace any of these categories to fit your needs.

Budgeting Step 2: Make your assumptions

You need to build in some assumptions in your budgeting plan to get a more realistic figure.

For example, here are my assumptions for the cost of raising a toddler. Yours may be different though.

- Healthcare cost will remain the same

- Housing cost will not be included (nothing’s changed since we had our baby)

- We planned to travel once this year (estimated cost: $1,200) – if the current pandemic crisis subsides (we are expats in Switzerland, so once a year, we’d like to visit our family in the States)

- Baby Bear will start childcare at 18 month part-time (estimated cost: $1,500/ month)

- All of the categories above will be calculated by the monthly average (except for food)

- Food cost will double

Budgeting Step 3: Crunch your numbers

This is the fun part! (Well, for me at least!)

To calculate your monthly budget, simply put all of your numbers together (historical spending + assumptions) in a table with the categories in rows and the time period in columns.

I recommend using a spreadsheet like Excel or Google Doc to keep things neat.

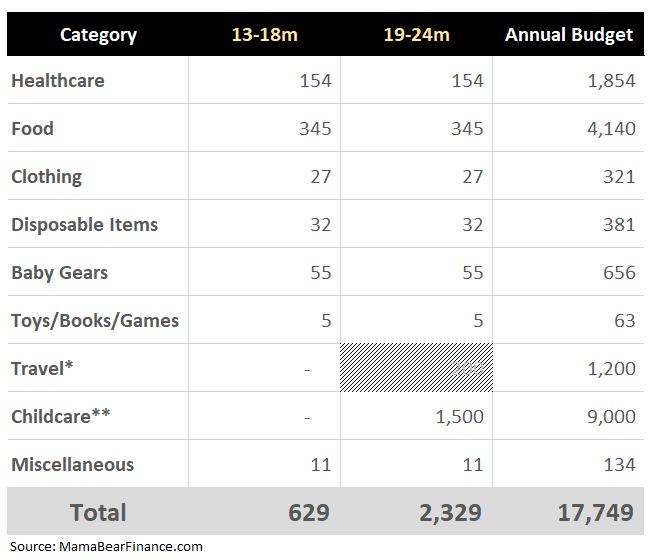

Here’s our final budgeting plan:

Note: The columns “13-18m” and “19-24m” are both MONTHLY budgets. This means that during my toddler’s 13-18 months, I planned to spend $629/month; and during her 19-24 months, I planned to spend $2,329/month.

I separated these two columns based on the assumptions that:

- Traveling will be done at the end of the year*

- Childcare will start at 19th month

(*I crossed off travel because it’s an annual budget reserved at year-end. Nevertheless, it’s included in the monthly figure for simplicity purpose.)

To get the annual budget figure, I simply multiply each of these columns by 6 months, and then add them all up.

Okay, and that was it! (That wasn’t too bad, right?)

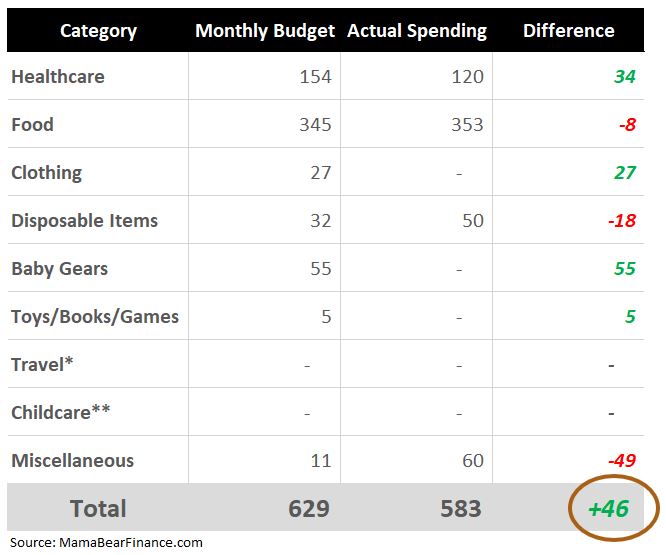

Now that we have our budgeting done, let’s see how it fared comparing to our ACTUAL 13th month spending. After all, a budget is a plan and the actual spending is our execution.

Luckily, I got the 13th month data!

Budgeting Plan vs. Actual Spending

*Travel cost will be incurred at year-end. **Childcare cost will be incurred starting at month 19. Therefore, they are $0.

Our monthly budget was $629 and we actually spent $583. That’s a $46 or 7% difference. Not bad!

This also means that we saved $46!

Of course, the category spendings were not aligned but that’s okay! A family budget is meant to be flexible. As long as your overall spending plan is moving in the right direction, then you’re doing great!

You can also check out how to save money WITHOUT using a budget.

Now, let’s take a look at the detail spending, shall we?

(Note: If you’ve been following along my 12-month expense tracking journey, you’ll know that I like to give details about each category spending. But if you’re a first-timer, welcome!)

At the end, I will also share Baby Bear’s developmental milestones at 13th month.

Breastfeeding: $0

I decided to wean Baby Bear at 13th month because my supply has really dropped dramatically since the 10th month. By the end of this month, Baby Bear naturally didn’t want to be breastfed anymore since my milk flow slowed down.

In this regard, both Baby Bear and I were in sync when it comes to weaning off breastfeeding. As a result, I didn’t spend any more money on repurchasing lecithin vitamins or lactation tea.

I’m so grateful to be able to breastfeed for 13 months (with 10 months of exclusive breastfeeding). Even though the journey was difficult, I’m so glad that I made it through and now Baby Bear’s body is jam packed with all the essential ingredients she received through my breast milk!

Healthcare: $120

We didn’t incur any out-of-pocket healthcare cost this month besides the monthly health insurance at $120/month.

Food: $353

We bought two cans of infant formula totaled $40, plus milk and oatmeal totaled $13. We have to supplement with formula starting at 11th month because my milk supply dramatically declined.

We also got 10 jars of baby food as gifts from our neightbor since they have an oversupply. This is great in case we travel, but otherwise I prefer to cook fresh meal for Baby Bear.

I do not track grocery cost as we buy in bulk, but I’ll assume that Baby Bear adds $300 in our monthly spending. Yes, food cost a lot in Switzerland! And I like to cook fresh homemade meals.

Clothing: $0

Few months ago, one of my mommy friends gave us a bunch of cute hand-me-downs but I didn’t have time to sort out what we need till this month. I decided to add 3 jackets and sweaters, 6 long sleeve shirts, 8 pants, 3 beanies, 1 glove, and 4 bibs to our inventory.

She gave us three bags and if I take in everything she gave us, it would overflow Baby Bear’s wardrobe. Therefore, I’ll just be adding few items at a needed basis.

We’re trying to stay as minimalists as possible since we planned to move back to the States from Switzerland in the near term.

Disposable Items: $50

We stocked up again on disposable diapers since there was a “buy 2 get 1 free” discount. We always stock up whenever there’s a sales. For a total of 8 packs, we paid about $45. This is just a generic brand from a Swiss supermarket but the quality matches that of Pampers.

While shopping, I happened to look up at the shelf in the diapers aisle and saw there there’s even disposable diapers for 8-years-olds and beyond.

I was in disbelief because I always thought that kids are potty trained by three years old (???). I have no idea actually, but 8 sounds excessive.

Currently, we are using a combination of cloth diapers and disposable ones. I have heard that cloth diapering can help with potty train earlier, so let’s see if it’s true!

We also bought two baby wipes for $5 total.

Miscellaneous: $60

We finally got Baby Bear’s French passport processed! It cost $29.

Papa Bear did a great job at DIY’ing her passport photo using his iPhone 10. It’s so much easier to take photo of a toddler at home than to take her to a professional or a photobooth. Not to mention it only cost $1 for printing.

I also donated to a kid’s indoor playground which is an open house for kids to play with the supervision of a parent. This place is free but you can make donation to keep the place running.

Related: Why I Track All of My Baby Expenses

Cost of Raising a Child

Since our actual spending remains quite close to the average 12-month spending, I think it’s safe to say that we should continue to spend the same amount until Baby Bear goes to childcare.

It’s going to significantly increase our household spending, but we think Baby Bear will really enjoy meeting new friends and doing activities with others of her age.

In summary, our total budgeted amount for year 2 will be $17,749.

It’s always important to review actual spending at year-end to plan for the following year so that you can get a more realistic figure on your new year’s budget.

Now that budgeting is done, here is Baby Bear’s 13th month developmental milestones.

Baby Development at 13th Month

Baby Bear is now eating well, sleeping well, and peeing and pooping well.

The biggest problem we had during her first year was feeding. First of all, breastfeeding was very difficult, but we made it through!

Secondly and for some reason, she just didn’t like eating from the 9th month till the 11th month. As a consequence, her weight was stagnant for these entire three months. This could be due to teething pain, but now she has fully bounced back and started to eat very well since she reached 1 year old.

Speaking of teething, she now has eight teeth! Four on the top and four on the bottom. She’s been drooling a bit more, too.

She also loves to talk…

She is now making sounds that resemble a question as she points to different things…

She’s curious and observant…

She loves to smile…

She hates it when we use our phone or get on the laptop…

She’s playful and loves going out…

She can wave hi and bye… and sometimes even blow kisses…

And she seems to understand some words very well like birds, light, eat, sleep, and let’s go out (her favorite!). Her next favorite word is Baba as she points to her dad. Unfortunately, she hasn’t said Mama yet. (It’s okay, I’ll wait.)

Finally, she can also stand on her own with support and slightly walk as she stands holding onto something. It’s incredible to see that. The only downside is that she can reach above the coffee table and the drawer handles. She can even open some cabinets and make a mess of our CD shelf.

This gives us major headache as we have to constantly keep a close eye on her to make sure that she doesn’t break stuff (and hurt herself along the way). Otherwise, her eye-hand coordination is very impressive as she can remove objects from a box and put them back in place.

I’m taking this opportunity to teach her how to clean up after herself (too early? I think not!). But to my failure, she insists on creating chaos.

All in all, we are happy to see her grow and develop into an active, vocal toddler (she’s still my Baby Bear though).

Related: 5 Ways to Increase Your Savings Quickly

How do you plan your family budget for child expenses? Do you think that budgeting is a useful way to gauge spending habits? What are some of your toddler’s 13th month developmental milestones?

Wanna PIN?

Kids are expensive. It’s estimated you will spend at least $250,000 on your child till they become an adult.

Yes, raising a kid can be exceptionally expensive especially for childcare cost. Everything else seems manageable though.

This is a cool breakdown. I had no idea before I had six kids. Haha!

Your kids are beautiful! I applaud you for getting it all together with 6 kids! Love your travel adventures!